In recent years, experimental economics has seen a rise in the collection and analysis of choice-process data, such as team communication transcripts. The main purpose of this paper is to understand whether the collection of team communication data influences how individuals reason and behave as they enter the team deliberation process, i.e. before any communication exchange. Such an influence would imply that team setups have limited validity to speak to individual reasoning processes. Our treatment manipulations allow us to isolate the effects of (1) belonging to a team, (2) actively suggesting an action to the team partner, and (3) justifying the suggestion in a written text to the team partner. Across three different tasks, we find no systematic evidence of changed suggestions and altered individual sophistication due to changes in aspects (1)–(3) of our experimental design. We thus find no threat to said validity of team setups. In addition to investigating how the team setup affects individual behavior before communication, we also investigate the sophistication of decisions after the communication. We find that sophisticated strategies are more persuasive than unsophisticated strategies, especially when communication includes written justifications, thereby explaining why teams are more sophisticated and proving rich communication to be fruitful.

BDM程序

BDM程序 (Becker, Degroot, and Marschak) 是一種廣泛使用的激勵相容機制,用於測量個人對消費品和其他體驗的價值(例如,Budescu、Weinberg和Wallsten,1988;Fox、Rogers和Tversky,1996;Kahneman、Knetsch和Thaler,1990;Prelec和Simester,2001)。在使用此程序時,參與者被告知可獲得貨物的銷售價格分佈,並被要求指出其保留價格。完成後,從價格分佈中隨機抽取一個售價(實現價格),並實施適當的結果:如果保留價格超過實現價格,決策者將獲得貨物並支付實現價格;如果保留價格低於實現價格,決策者將不獲得貨物並且不支付任何費用。

==see also==

Becker, Gordon M., Morris H. Degroot, and Jacob Marschak. “Measuring utility by a single-response sequential method." Behavioral Science 9.3 (1964): 226-232. [pdf]

Adding asymmetrically dominated alternatives: Violations of regularity and the similarity hypothesis

Huber, Joel, John W. Payne, and Christopher Puto. “Adding asymmetrically dominated alternatives: Violations of regularity and the similarity hypothesis." Journal of consumer research 9.1 (1982): 90-98.

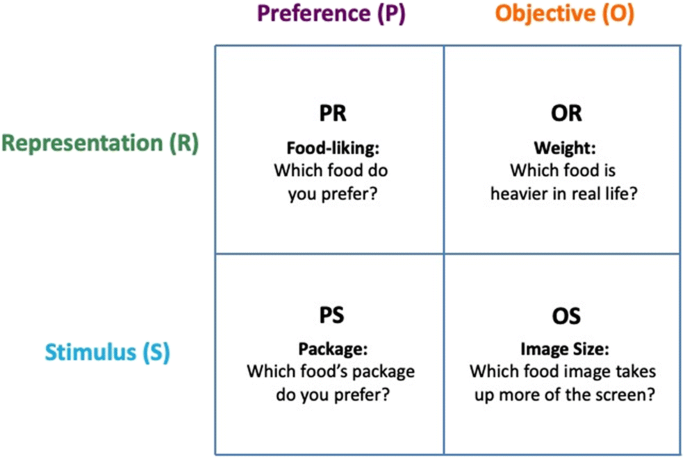

Mental representations distinguish value-based decisions from perceptual decisions

Smith, Stephanie M., and Ian Krajbich. “Mental representations distinguish value-based decisions from perceptual decisions." Psychonomic Bulletin & Review 28 (2021): 1413-1422. [web] [pdf]

==YNY’s notes==

value-based 和 perceptual decisions 的分類和例子

For example, value-based decisions include choosing which food you want to eat or which gamble you want to take, while perceptual decisions include determining which direction a group of flickering dots is moving (Roitman & Shadlen, 2002) or which line segment is closest to horizontal (as in Tavares et al., 2017).

However, there is another important divide typical of these tasks: the source of information required to make the decision. Perceptual decisions generally rely on evaluations of stimuli, while value-based decisions rely on memory-based representations. This second division follows from research that has established distinct neural mechanisms for memory versus perception (Eichenbaum & Cohen, 2014; Squire & Zola-Morgan, 1991; Suzuki & Baxter, 2009).

==see also==

The Phantom Decoy Effect in Perceptual Decision Making

Trueblood, Jennifer S., and Jonathan C. Pettibone. “The phantom decoy effect in perceptual decision making." Journal of Behavioral Decision Making 30.2 (2017): 157-167. [PDF] wiley.com

==abstract==

幻影誘餌是指一種在進行選擇時,尚不存在的替代方案,但這個方案卻優於另一個“目標”選擇。…

A phantom decoy is an alternative that is superior to another “target” option but is unavailable at the time of choice. In value-based decisions involving phantom decoys (e.g., consumer choices), individuals often show increased preference for the similar, inferior target option over a non-dominated competitor alternative. Unlike value-based decisions that are driven by subjective goals, perceptual decisions typically have an outside criterion that defines the goal of the task (e.g., target is present or absent). Despite their obvious differences, past research has documented a number of commonalities between both types of decisions. In a set of three experiments, we examine the influence of phantom options on simple perceptual decisions and point out a critical difference between perceptual and value-based decisions. Our results show that in perceptual choice, participants prefer competitor options to target options, the opposite of the pattern typically found in consumer choice. We use the results of the experiments to examine the predictions of four different models of context effects including loss aversion and dynamic, preference accumulation models. We find that accumulation models provide the best explanation for our results as well as being able to generalize to other context effects.

==refer to==

感知決策是指利用感官信息引導行為以應對外部世界的過程

Perceptual decision making is the process by which sensory information is used to guide behavior toward the external world. (2014)

在感知決策過程中,即使在兩者對正確決策同樣具有信息的任務中,受試者通常更強烈地依賴早期感官證據,而不是後期證據。During perceptual decisions, subjects often rely more strongly on early, rather than late, sensory evidence, even in tasks when both are equally informative about the correct decision. (2018)

感知決策是根據現有感知信息從一組選項中做出選擇的行為 Perceptual decision making is the act of choosing one option from a set of alternatives based on available sensory information. (2020)

Worth Your Weight: Experimental Evidence on the Benefits of Obesity in Low-Income Countries

Macchi, Elisa. 2023. “Worth Your Weight: Experimental Evidence on the Benefits of Obesity in Low-Income Countries." American Economic Review, 113 (9): 2287-2322. (DOI: 10.1257/aer.20211879)

Abstract

I study the economic value of obesity—a status symbol in poor countries associated with raised health risks. Randomizing decision-makers in Kampala, Uganda to view weight-manipulated portraits, I find that obesity is perceived as a reliable signal of wealth but not of beauty or health. Thus, leveraging a real-stakes experiment involving professional loan officers, I show that being obese facilitates access to credit. The large obesity premium, comparable to raising borrower self-reported earnings by over 60 percent, is driven by asymmetric information and drops significantly when providing more financial information. Notably, obesity benefits and wealth-signaling value are commonly overestimated, suggesting market distortions.

The Power of Certainty: Experimental Evidence on the Effective Design of Free Tuition Programs

Burland, Elizabeth, Susan Dynarski, Katherine Michelmore, Stephanie Owen, and Shwetha Raghuraman. 2023. “The Power of Certainty: Experimental Evidence on the Effective Design of Free Tuition Programs." American Economic Review: Insights, 5 (3): 293-310.

Abstract

Proposed “free college" policies vary widely in design. The simplest set tuition to zero for everyone. More targeted approaches limit free tuition to those who demonstrate need through an application process. We experimentally test the effects of these two models on the schooling decisions of low-income students. An unconditional free tuition offer from a large public university substantially increases application and enrollment rates. A free tuition offer contingent on proof of need has a much smaller effect on application and none on enrollment. These results are consistent with students placing a high value on financial certainty when making schooling decisions.

.

The boomerang effect of zero pricing: when and why a zero price is less effective than a low price for enhancing consumer demand

Xiaomeng Fan, Fengyan Cindy Cai, Galen V Bodenhausen

Journal of the Academy of Marketing Science 50 (3), 521-537, 2022

Prior literature has demonstrated the power of zero pricing to boost consumer demand, but the current research shows a novel “boomerang effect”(自作自受): a zero (vs. low, nonzero) price can lower demand when the offer comes with high incidental costs (e.g., the time cost in commuting to an offline class; the physical risk of getting a new vaccine). Five studies show that zero pricing, relative to low pricing, has a boosting (boomerang) effect on demand when incidental costs are low (high). The diverging effects of zero pricing on demand are explained by a dual-process model with a positive affective pathway and negative scrutiny pathway. Zero pricing triggers both positive affect and cognitive scrutiny of incidental costs; when incidental costs are high, the scrutiny pathway overrides the affective pathway and decreases demand. The finding has managerial implications as incidental costs often vary widely between marketing channels and over a product’s life cycle

Platform economics and antitrust enforcement: A little knowledge is a dangerous thing

Katz, Michael L. “Platform economics and antitrust enforcement: A little knowledge is a dangerous thing." Journal of Economics & Management Strategy 28.1 (2019): 138-152.[PDF]

==abstract==

Although the economics of multisided platforms has developed important insights for antitrust policy, there are critical respects in which the body of academic knowledge falls short of providing useful advice to enforcement agencies and the courts. Indeed, there is a substantial risk that recent scholarship will be misapplied to the detriment of sound antitrust policy, as evidenced by the US Supreme Court’s recent decision in American Express. In this note, I identify several areas in which economics research could potentially make significant contributions to the practical antitrust treatment of platforms.

“Justice Stephen Breyer’s dissent mocks the majority’s economic reasoning, as will most economists, including the creators of the “two-sided markets” theory on which the court relied. The court used academic citations in the worst way possible — to take a pass on reality.”

—Wu (2018b) commenting on the Supreme Court’s American Express opinion.

「零元效應」有助抑制醫療浪費

中研院經濟研究…表示,日本以7至14歲兒少就醫研究發現,門診部分負擔從0元小幅提高至2美元(約新台幣55元)時,門診次數顯著降低,並減少非必要抗生素使用;不過,若從55元變成110元,則變化有限。

自由時報電子報: 健保部分負擔將改革 學者:「零元效應」有助抑制醫療浪費. https://news.ltn.com.tw/news/life/breakingnews/3832255